Measures to cool food inflation will deliver in coming weeks, says Finance Ministry

The Hindu

Core inflation below 6% for 4th successive month, says Finance Ministry

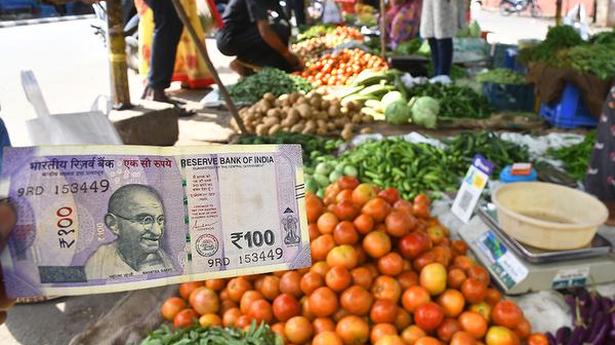

The Finance Ministry late Monday termed the increase in retail inflation from 6.71% in July to 7% in August as ‘moderate’, and attributed it to an adverse base effect and an increase in food and fuel prices, which it called “the transient components” of Consumer Price inflation.

Core inflation, which excludes these ‘transient components’ of food and beverages as well as fuel and light inflation, was recorded at 5.9% in August, remaining below the tolerance limit of 6% for the fourth consecutive month, the Ministry emphasised.

“Despite erratic monsoons and negative seasonality in vegetable prices, food inflation in July still lower than the April peak of the current year. To soften the prices of edible oils & pulses, tariffs on imported items have been rationalised periodically & stock limits on edible oils have been kept, to avoid hoarding,” the Ministry said.

Stressing that inflation in “oils and fats” and “pulses and products” have moderated to 5.62% and 2.52% respectively, the Ministry said the Government “has prohibited exports of food products like wheat flour/atta, rice, maida, etc. to keep domestic supplies steady and curb rise in prices”.

“The impact of these measures is expected to be felt more significantly in the coming weeks and months,” it underlined.

“With global inflation pressures, inflationary expectations remain anchored in India with stable core inflation,” the Ministry said, citing a July survey by IIM-Ahmedabad which said ‘one-year ahead Business Inflation Expectations Survey has declined by 34 basis points to 4.83% from 5.17% in June’. One basis point equals 0.01 percentage points.

“Inflation expectations have fallen below 5% after 17 months,” the Ministry said. “Prices of major inputs like iron ore & steel have sobered in the global markets. This, coupled with the measures taken by the Govt. to rationalise tariff structures of inputs to augment domestic supply, has helped to keep cost push inflation in consumer items under control,” it concluded.

When Union Minister for Road Transport and Highways, Nitin Gadkari, recently spoke about the transformative potential of Vehicle-to-Vehicle (V2V), a technology for autonomous driving in India, he framed it as a critical lever for safer roads, smarter traffic management and future-ready mobility. That vision is already finding concrete expression inside Samsung Electronics-owned HARMAN Automotive’s India operations, which are emerging as a global hub for software-defined and connected vehicle technologies, says Krishna Kumar, Managing Director and Automotive Head, HARMAN India.

ICICI Bank Ltd., the second largest private sector bank, for the third quarter ended 31 December 2025 reported 4% drop in net profit to ₹11,318 crore as compared to ₹ 11,792 crore in the year ago period on account of making additional standard asset provision of ₹1,283 crore during the quarter as per direction of the Reserve Bank of India (RBI).