Tales from the crypt

The Hindu

Cryptocurrency fraud in India: Victims lured by promises of high returns, leading to losses worth crores; legal ambiguity persists.

Sometime in 2009, Internet users took note of the emergence of Bitcoin, a new and exclusively online digital asset, especially in how it sidestepped all banking regulations. Nearly six years later, several dubious cryptocurrency firms began emerging nationwide. Aided by attractive marketing campaigns, seminars, word-of-mouth promotions, promises of 10-40% monthly returns, and Bitcoin’s surging market value, these firms baited thousands of people, including those who did not fully understand the technology, into parting with their investments.

“Initially, when it started in 2015, my brother and I made a small investment. We were confident that our returns would increase manifold,” said Sukhwant Singh, a resident of Uttarakhand’s Rudrapur district, about a cryptocurrency platform named BTC Fund. The firm promised its investors 30% monthly returns in the first couple of months.

“We kept putting in money. By 2017, we had invested around ₹50 lakh,” Sukhwant added. Gradually, the returns were delayed, and one day, they stopped altogether. When the firm’s owner stopped picking up his calls, he knew he had been scammed. Sukhwant, the primary breadwinner of his family, has since taken up odd jobs to recover from the financial crisis.

Since it took over the investigation in the BTC Fund case, the Enforcement Directorate (ED), the country’s premier financial law enforcement agency, has attached assets worth a total of ₹4.56 crore.

A provision under Section 8(8) of the Prevention of Money Laundering Act, introduced in 2015, allows for the restitution of attached properties with court’s approval, giving hope to the victims of getting their money back in time.

Over the past 10 years, investors such as Sukhwant are estimated to have been swindled of tens of thousands of crores of rupees.

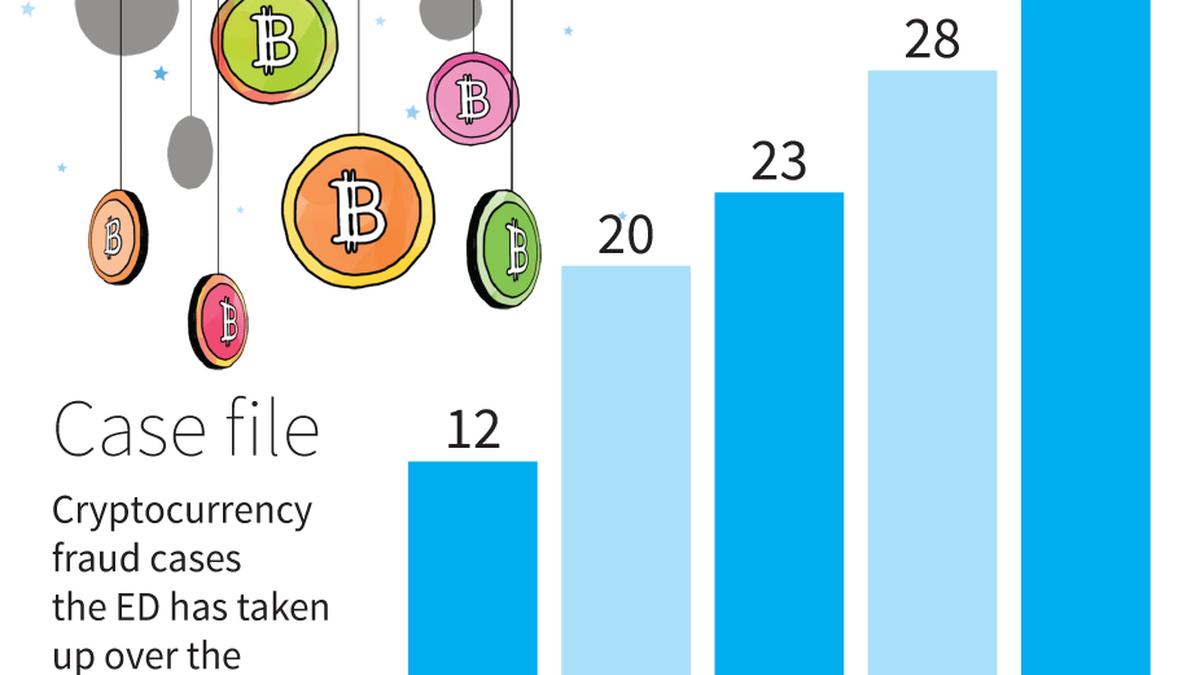

As per a senior ED official, the actual numbers are likely to be much higher as many victims tend not to share their plight out of fear of getting into legal trouble. The agency received its first case of cryptocurrency fraud in 2017-18. Since then, it has taken up a total of 122 such cases.