Rupee falls 2 paise to close at 83.04 against U.S. dollar

The Hindu

At the interbank foreign exchange market, the local unit opened at 83.00 and finally settled at 83.04 (provisional)

The rupee consolidated in a narrow range and depreciated by 2 paise to close at 83.04 (provisional) against the U.S. dollar on Thursday, tracking a strong American currency and elevated crude oil prices in the international market.

Forex traders said the Indian currency depreciated as foreign fund outflows weighed on the rupee. However, positive domestic markets cushioned the downside.

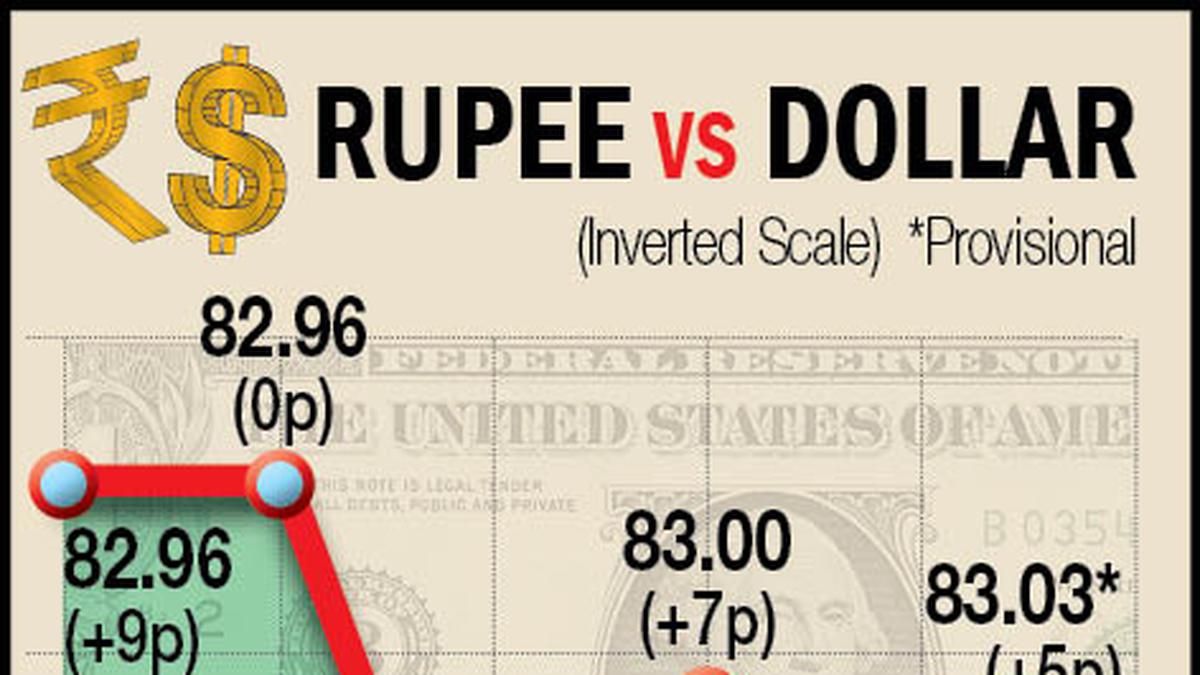

At the interbank foreign exchange market, the local unit opened at 83.00 and finally settled at 83.04 (provisional) against the dollar, down by 2 paise from its previous close.

During the day, the rupee witnessed a range-bound movement. It saw an intra-day high of 82.99 and a low of 83.04 against the American currency.

On Wednesday, the rupee appreciated 6 paise to close at 83.02 against the U.S. dollar.

"We expect the rupee to trade with a slight positive bias on rise in risk appetite in global markets and a negative tone in the U.S. dollar. Overnight decline in global crude oil prices and better than expected trade balance may further support rupee," said Anuj Choudhary, Research Analyst, Sharekhan by BNP Paribas.

However, concerns over FII outflows may cap sharp upside.