Leaked files reveal CRA refunded millions by mistake

CBC

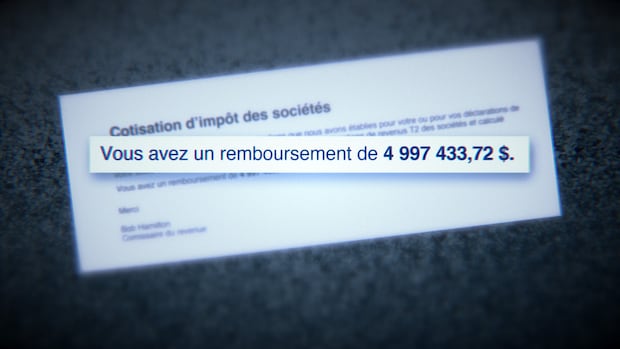

More than two years after paying out $4.99 million in an allegedly bogus refund, the Canada Revenue Agency is stuck in Federal Court trying to figure out where the money went and how to get it back.

The seven-figure refund was issued through the CRA’s automated processes in the spring of 2023 to Distribution Carflex Inc., a cash-strapped body shop in the Laurentians region of Quebec.

According to internal records obtained by the CBC’s the fifth estate and Radio-Canada, the $4.99-million transaction went through automatically, as it fell just short of a $5-million threshold for manual review in this type of tax refund.

A source with inside knowledge of the CRA’s workings said that returns are routinely processed electronically without human oversight, even in cases where millions are paid out that would later raise red flags.

“There should be eyeballs on that transaction, but there isn't, and that's the problem,” said the source.

CBC is not disclosing the identity of the source, who is not authorized to discuss the internal workings of the CRA or specific tax files.

If the $5-million threshold had been met, CRA auditors would have performed a manual review of the tax return and might have noticed potential irregularities, the source said.

The $4.99-million reimbursement was issued on the premise that Carflex had paid taxes on a large capital gain, but auditors later found no record of such a payment.

The payment first attracted attention at TD bank, the institution where the money was deposited, and not the CRA, according to the leaked records.

The leaked Carflex documents are the most recent example of numerous instances uncovered by the fifth estate and Radio-Canada, which show the CRA has allegedly been duped into paying large reimbursements without conducting basic checks, affecting tens of thousands of taxpayers and raising questions about the agency’s credibility with the public.

Carflex’s owner, Yvan Drapeau, and his lawyer could not be reached for comment by email or phone.

According to documents filed in court, they have defended the transactions as valid and fought back against the CRA’s attempts to freeze its account.

At Federal Court, the CRA is trying to recover the money, alleging the firm “did not have a right to this refund.”

“Carflex is the one that caused the overpayment from the CRA through transactions that were questionable and potentially fraudulent,” agency officials have said in court.

Missing baby presumed dead after father charged with killing mother in St. Albert, Alta., police say

A man is facing charges in the death of a young mother in the Edmonton area and the presumed death of their missing nine-month-old daughter.