RBI keeps repo rate unchanged at 6.5% for 8th time in a row

The Hindu

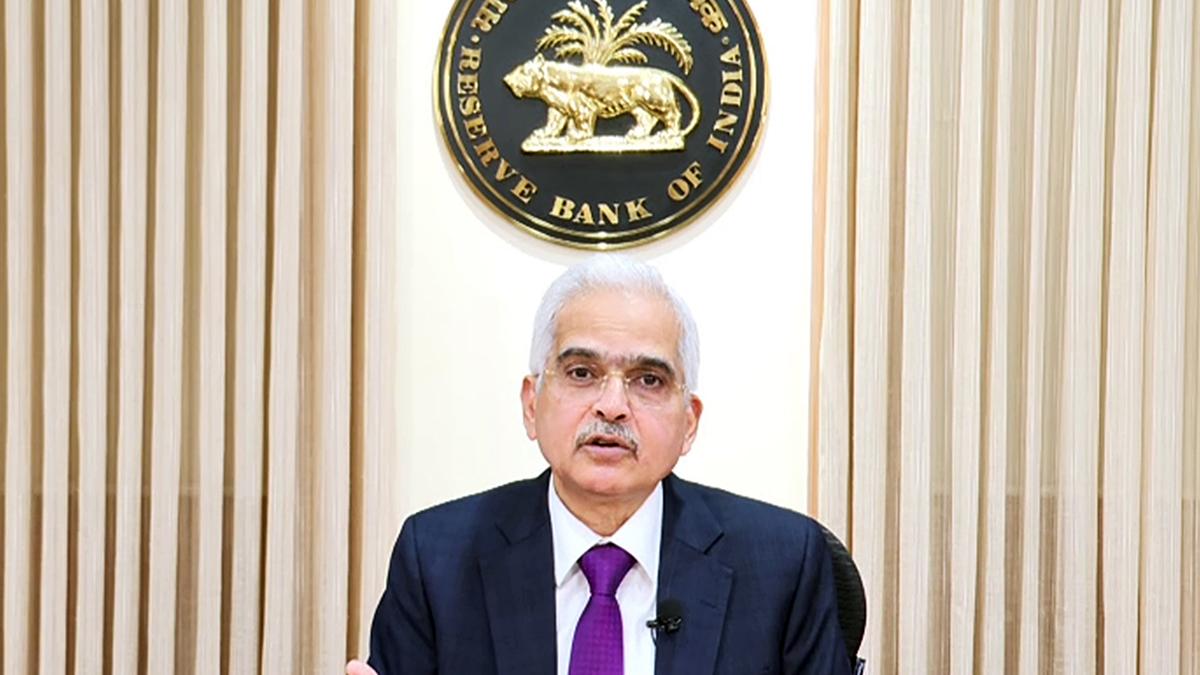

RBI Governor Shaktikanta Das keeps repo rate steady at 6.5% amid expectations of unchanged benchmark interest rates.

The Reserve Bank of India (RBI) on June 7 decided to keep the policy rate unchanged for the eighth time in a row, saying it will maintain a tight vigil on inflation.

The rate increase cycle was paused in April last year after six consecutive rate hikes, aggregating to 250 basis points since May 2022.

Announcing the second bi-monthly monetary policy for the current financial year, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged at 6.5%.

He said MPC will remain watchful of elevated food inflation amid the expectation of a normal monsoon.

The RBI raised the growth projection to 7.2% from an earlier estimate of 7% for the current financial year.

Mr. Das announced the decision at 10 in the morning after deliberations of the RBI’s rate-setting panel — MPC — which started discussions on Wednesday.

The government has mandated the RBI to ensure retail inflation at 4% with a margin of 2% on either side. Retail inflation was 4.83% in April this year.