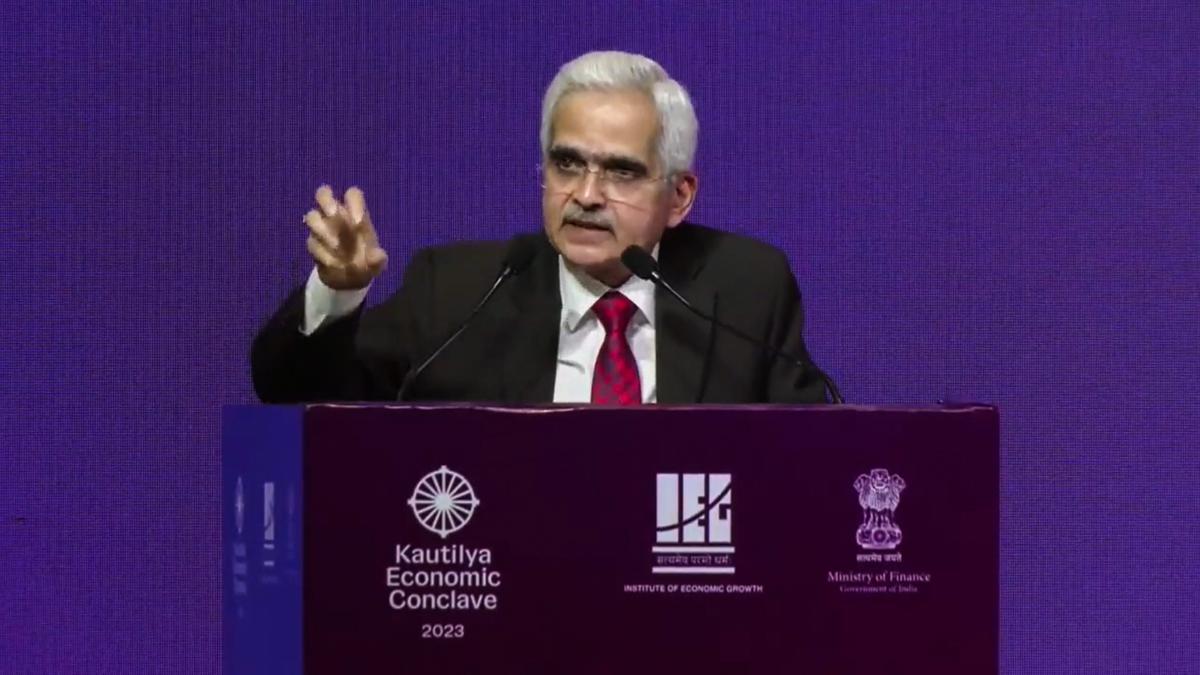

Monetary policy ought to remain actively disinflationary: RBI governor Shaktikanta Das

The Hindu

Reserve Bank of India (RBI) governor Shaktikanta Das on October 20 stressed that the monetary policy must remain actively disinflationary to ensure that the decline in inflation from its peak of 7.44% in July continues smoothly.

Reserve Bank of India (RBI) governor Shaktikanta Das on October 20 stressed that the monetary policy must remain actively disinflationary to ensure that the decline in inflation from its peak of 7.44% in July continues smoothly.

Addressing the Kautilya Economic Conclave 2023, he also said price stability and financial stability complement each other and it has been an endeavour at RBI to manage both efficiently.

Retail inflation declined to a three-month low of 5.02% annually in September on account of moderation in vegetables and fuel prices, and was back within the Reserve Bank's comfort level.

The inflation based on Consumer Price Index (CPI) was 6.83% in August and 7.41% in September 2022. In July, inflation touched a peak of 7.44%.

The Reserve Bank has raised the key policy rate (repo) by 250 basis points since May 2022 to tame inflation. However, it pressed the pause button on rate hike in February this year.

"We have maintained a pause on policy rate. So far 250 basis points rate hike is still working through the financial system. We have also appropriately fine-tuned our communication to ensure a successful transmission of the interest rate hikes," the governor said.

When Union Minister for Road Transport and Highways, Nitin Gadkari, recently spoke about the transformative potential of Vehicle-to-Vehicle (V2V), a technology for autonomous driving in India, he framed it as a critical lever for safer roads, smarter traffic management and future-ready mobility. That vision is already finding concrete expression inside Samsung Electronics-owned HARMAN Automotive’s India operations, which are emerging as a global hub for software-defined and connected vehicle technologies, says Krishna Kumar, Managing Director and Automotive Head, HARMAN India.

ICICI Bank Ltd., the second largest private sector bank, for the third quarter ended 31 December 2025 reported 4% drop in net profit to ₹11,318 crore as compared to ₹ 11,792 crore in the year ago period on account of making additional standard asset provision of ₹1,283 crore during the quarter as per direction of the Reserve Bank of India (RBI).