Explained: What is GST e-invoicing? What’s changed from April 1, 2025? Premium

The Hindu

GST Council approved e-invoicing system for B2B invoices, with new rules and regulations, mandatory for all taxpayers from April 1.

The Story so far: The GST Council of India approved and rolled out the ‘e-invoicing’ or ‘electronic invoicing’ eco-system in a phased manner for reporting of business-to-business (B2B) invoices to GST portal. As there were no existing standards/formats then, a standardised format was introduced across the country, after having several consultations with trade/industry bodies as well as Institute of Chartered Accountants of India. Since then, several changes were also being made to the GST e-invoicing rules and regulations. Before getting into the details of what is GST e-invoicing and how this works, let’s first check out the new rules.

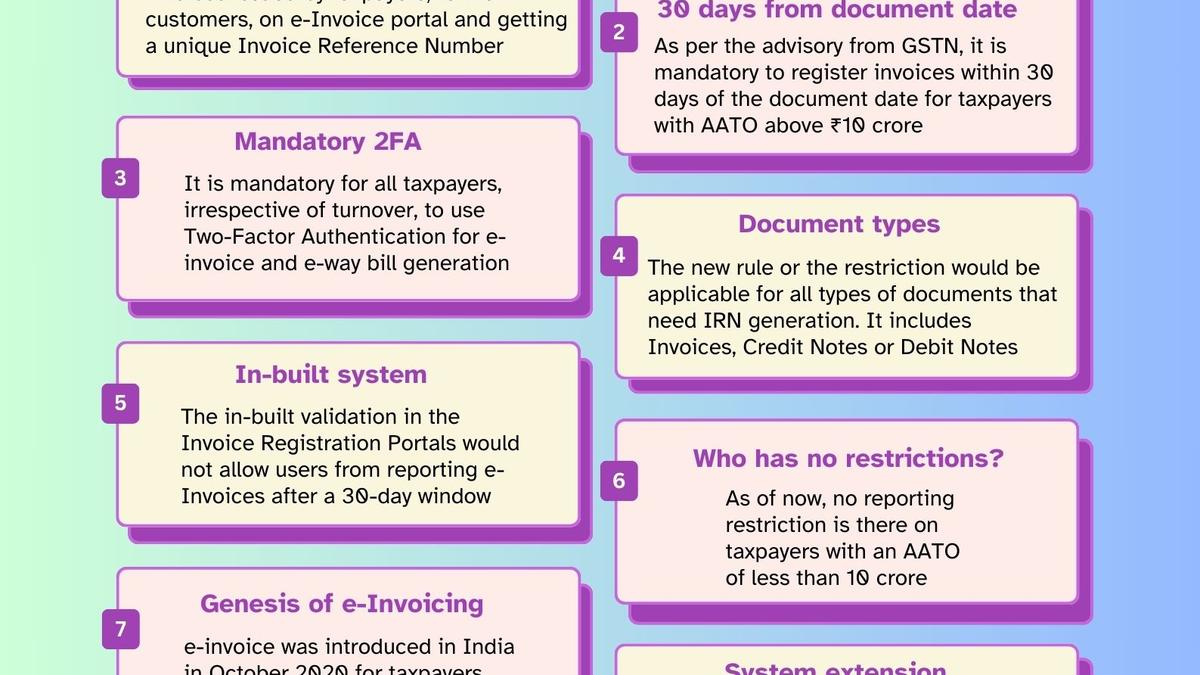

From April 1, 2025, business houses with an Annual Aggregate Turn Over (AATO) of ₹10 crore and above must report/upload e-invoices to the Invoice Registration Portal (IRP) within 30 days from the date of issue of the document. Earlier, this rule was meant only for business houses with an AATO of more than ₹100 crore. As the turnover threshold has been reduced drastically, large number of business houses must comply with this 30-day deadline.

Currently, there are no strict regulations on the deadline of reporting invoices. Therefore, a few businesses upload invoices in a delayed manner, thereby creating discrepancies in Input Tax Credit (ITC) claims and overall tax compliance. But now, the in-built validation in the IRPs would not allow users from reporting e-Invoices after the 30-day window. Late submissions would automatically be rejected, with consequences leading to potential penalties and financial setbacks.

From April 1, it is mandatory for all taxpayers, irrespective of turnover, to use Two-Factor Authentication (2FA) system for e-invoice and e-way bill generation.

GST e-invoicing involves reporting of B2B invoices and export invoices issued by taxpayers, to their customers, on the Union Government’s e-invoice portal and getting a unique Invoice Reference Number (IRN). This doesn’t mean that the invoice would be generated by the government portal itself. Further, e-invoice doesn’t simply mean that the invoice would be in a soft copy version such as PDF. According to the GST portal, “It’s a faceless system with major thrust on API integration so that the eco-system can exchange the data electronically.”

The standard of GST e-invoice was first approved by the GST Council in its 37th meeting held on September 20, 2019. e-Invoicing was introduced in India, in a phased manner, in October 2020 for taxpayers with Annual Aggregate Turn Over (AATO) of more than ₹500 crore. Later, in January 2021, the eco-system was extended to taxpayers with AATO between ₹100 and ₹500 crore.

The types of documents that need to be uploaded for IRN generation include GST Invoices, Credit Notes or Debit Notes related to B2B supplies and exports.