Why the tax cuts are a one way gamble

The Hindu

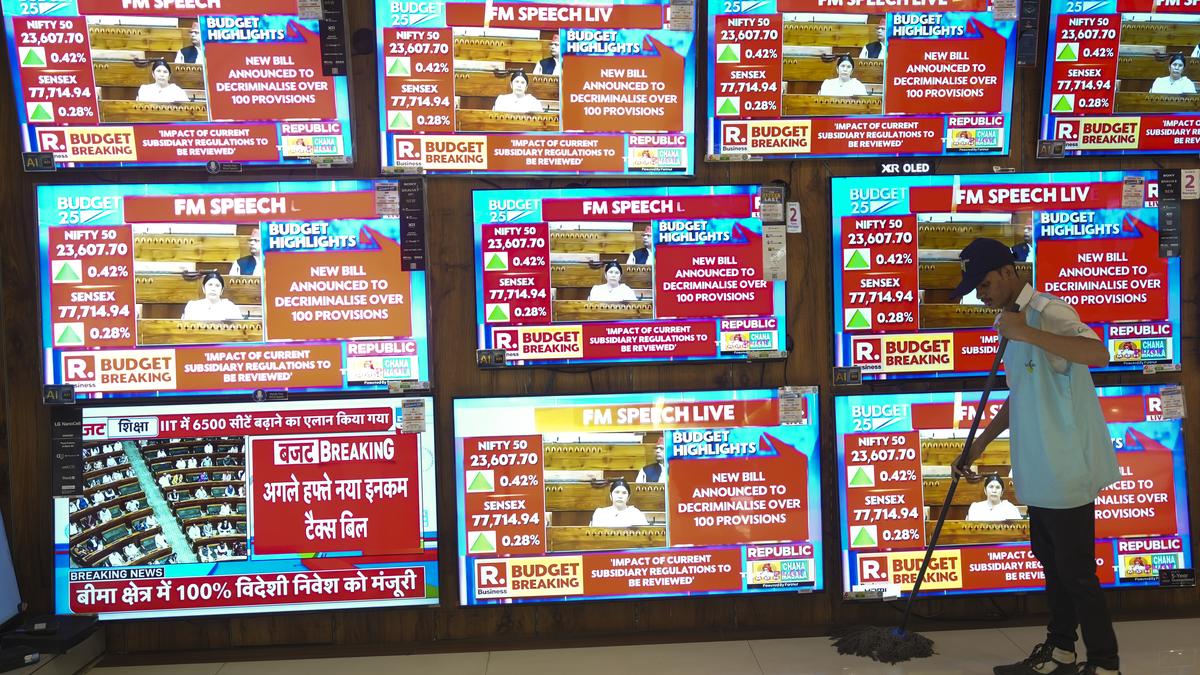

Unprecedented tax cuts in the Union Budget benefit a small minority, raising concerns about fiscal policy and economic growth.

It would not be an exaggeration to say that this is the biggest tax cut that the middle class has ever got in any Union Budget. To be sure, the tax-paying middle class in India is nowhere near “middle” of the income spectrum and, hence, those who would directly benefit from these cuts are a minuscule minority (between 2-3% of the population). Nevertheless, it is indeed a significant cut in tax rates for every class of taxpayer. For those earning between ₹7-₹12 lakh a year, it is a complete tax rebate, which was earlier applicable to only those below ₹7 lakh. For others earning more than ₹12 lakh, the exemption limit has increased from ₹3 to ₹4 lakh. The rest of the tax slabs have also changed favourably along with a cut in the marginal tax rates. So, everyone earning more than ₹7 lakh stands to gain in taxes payable. No wonder this step, as noted by the Finance Minister, will lead to a fall in tax revenue to the tune of ₹1 lakh crore. This is 8% of the direct income tax collection of ₹12.57 lakh crore in the current year.

Also Read: Union Budget 2025: Tax break will give a fillip to slowing economy, says Centre

Budgets are an exercise in both a redistribution of income (through differential variation in tax rates) and affecting the level of economic activity through its expenditure decisions.

Since the tax rebate has implications for both, and a lot of the plans of the 2025 Budget ride on it, this piece primarily focuses on this unprecedented fall in income tax rates.

Despite the fall of 8% in the effective tax rate as a result of this policy, the Budget has estimated direct tax collection to go up by 14%. A simple arithmetic calculation would tell us that this requires the rise of income to be around 24% (see Box 1).

With a projected growth of 10.1% in nominal GDP, this means more than double the growth in taxpayers’ income. This may or may not happen. Let’s discuss each of the two scenarios.

First, the optimistic scenario. In the backdrop of higher tax exemption limits (from ₹7 to ₹12 lakh for zero tax and ₹3 to ₹4 lakh for those earning more than 12 lakh), this would require either a significant rise in the number of people earning more than ₹12 lakh and/or a significant rise in the income of the current taxpayers, that is, what economists would call higher tax buoyancy. If it’s the latter, this means further concentration of income in the hands of the upper classes. This may just further the K-shaped growth that the country has witnessed since the pandemic. And if it’s the former, this may reflect some upward mobility at the upper end of the income spectrum.

Scaling Artificial Intelligence(AI) at the speed at which consultants project is not possible by the laws of physics and may not be environmentally sustainable, said Tanvir Khan, who is the Executive Vice President and Chief Operating Officer of NTT DATA North America, part of the Japanese technology services and data centre company NTT Data, in an interview with The Hindu.