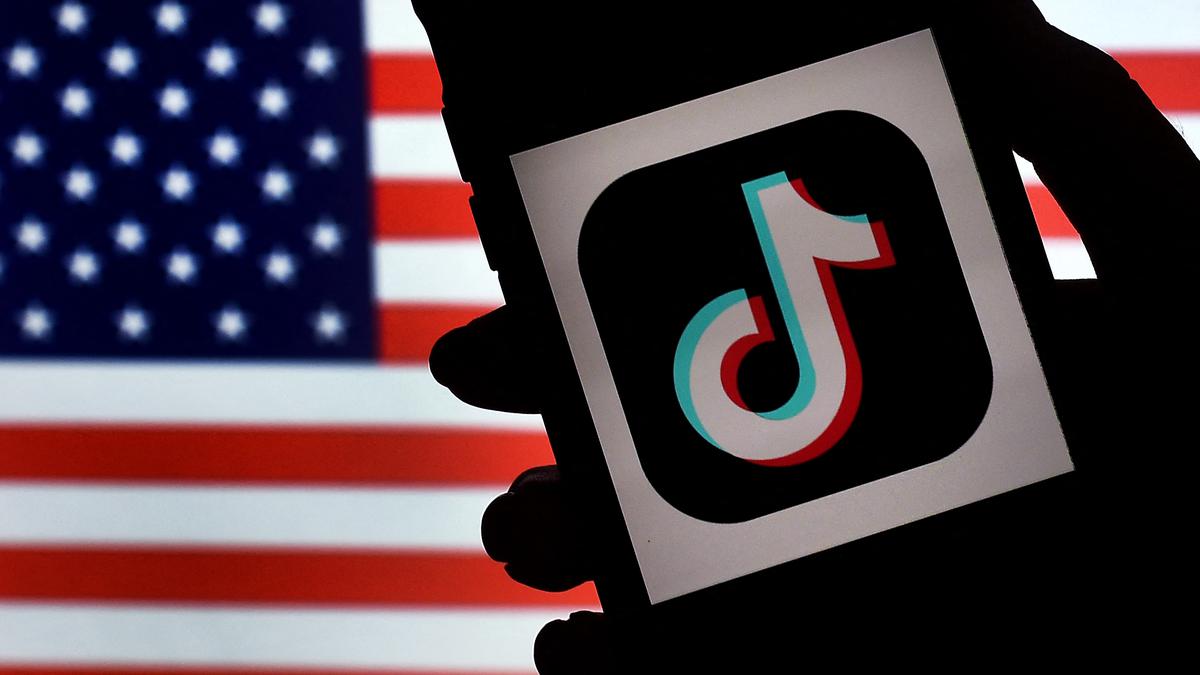

TikTok dismisses calls for Chinese owners to divest in U.S.

The Hindu

Washington

TikTok was dismissive of reports that the Biden administration was calling for its Chinese owners to sell their stakes in the popular video-sharing app, saying such a move wouldn't help protect national security.

The company was responding to a report in The Wall Street Journal that said the Committee on Foreign Investment in the U.S., part of the Treasury Department, was threatening a U.S. ban on the app unless its owners, Beijing-based ByteDance Ltd., divested.

"If protecting national security is the objective, divestment doesn't solve the problem: a change in ownership would not impose any new restrictions on data flows or access," TikTok spokesperson Maureen Shanahan said.

"The best way to address concerns about national security is with the transparent, U.S.-based protection of U.S. user data and systems, with robust third-party monitoring, vetting, and verification, which we are already implementing." The Journal report cited anonymous "people familiar with the matter." The Treasury Department and the White House's National Security Council declined to comment.

Late last month, the White House gave all federal agencies 30 days to wipe TikTok off all government devices.

The Office of Management and Budget called the guidance a "critical step forward in addressing the risks presented by the app to sensitive government data." Some agencies, including the Departments of Defense, Homeland Security and State, already have restrictions in place. The White House already does not allow TikTok on its devices.

Congress passed the "No TikTok on Government Devices Act" in December as part of a sweeping government funding package. The legislation does allow for TikTok use in certain cases, including for national security, law enforcement and research purposes.

GCCs keep India’s tech job market alive, even as IT services industry embarks on a hiring moratorium

Global Capability Centres, offshore subsidiaries set up by multinational corporations, mostly known by an acronym GCCs, are now the primary engine sustaining India’s tech job market, contrasting sharply with the hiring slowdown witnessed by large firms in the country.

Mobile phones are increasingly migrating to smaller chips that are more energy efficient and powerful supported by specialised Neural Processing Units (NPUs) to accelerate AI workloads directly on devices, said Anku Jain, India Managing Director for MediaTek, a Taiwanese fabless semiconductor firm that claims a 47% market share India’s smartphone chipset market.

In one more instance of a wholly owned subsidiary of a Chinese multinational company in India getting ‘Indianised’, Bharti Enterprises, a diversified business conglomerate with interests in telecom, real estate, financial services and food processing among others, and the local arm of private equity major Warburg Pincus have announced to collectively own a 49% stake in Haier India, a subsidiary of the Haier Group which is headquartered in Qingdao, Shandong, China.