Rupee closes stronger, outperforms major Asian peers in January

The Hindu

The Indian rupee ended higher buoyed by dollar sales from both local and foreign banks.

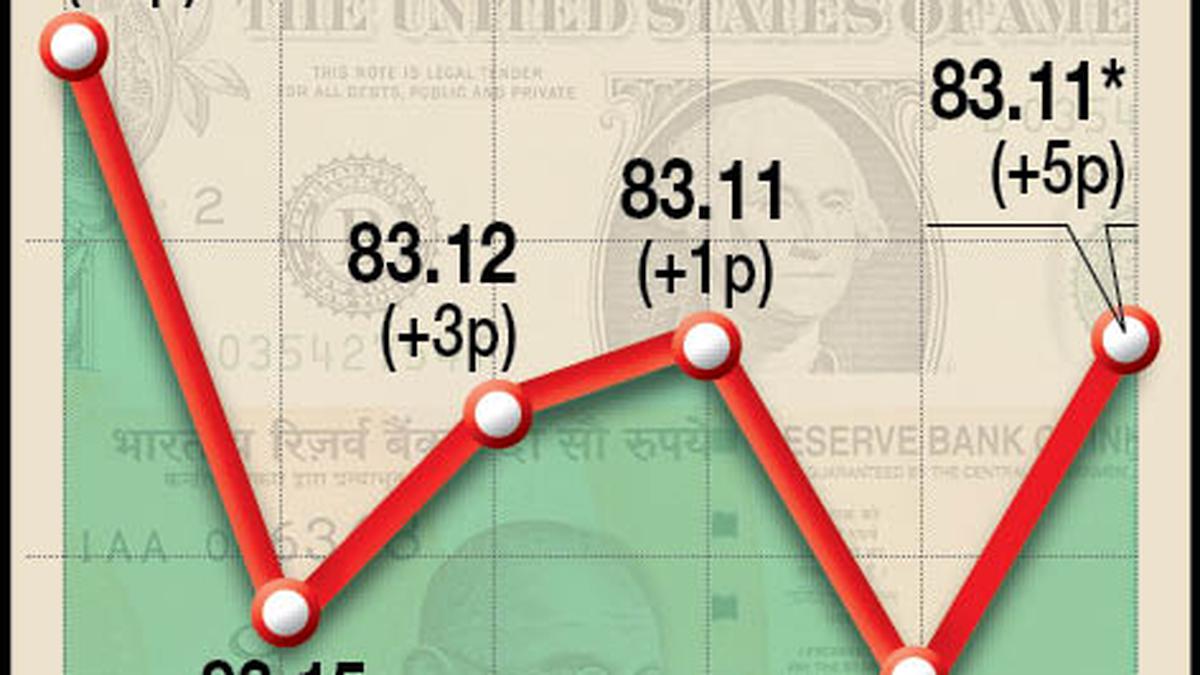

The Indian rupee ended higher on Wednesday, buoyed by dollar sales from both local and foreign banks, which lifted the local unit to its strongest level in over two weeks.

The rupee ended at 83.0425 against the U.S. dollar, compared with its previous closing of 83.1050.

The local currency logged a 0.2% increase in January, marking its strongest monthly rise since June 2023. The rupee's Asian peers were down between 0.8% and 3% in the month.

Dollar sales from large foreign banks aided the rupee in the latter half of Wednesday's session, a foreign exchange trader at a private bank said.

However, its ascent above the 83.05 level attracted bids on the dollar-rupee pair, limiting gains, the trader added.

The dollar index was relatively unchanged at 103.49 but appeared on course to notch a monthly gain of slightly above 2%.

The rupee held its ground in January despite a resurgence in dollar strength, driven by the paring of aggressive rate cut bets in the U.S., which put pressure on its Asian counterparts.

According to recent Foreign Trade Performance Analysis data, India’s overall exports remained resilient in late 2025, even as traditional sectors faced sharp declines. While shipments of gems and jewellery to the U.S. plummeted, the overall figures were bolstered by a massive 237% surge in telecom exports, particularly smartphones. Data shows that Indian exporters are aggressively diversifying their portfolios. By deepening ties with existing partners and discovering new alliances, India is replacing lost U.S. sales with a more diversified set of trade partners