Rise in repatriation sign of mature market: RBI Governor on moderation in net FDI

The Hindu

Reserve Bank Governor highlights India's strong FDI inflows, robust trade, and resilient external sector in 2024-25.

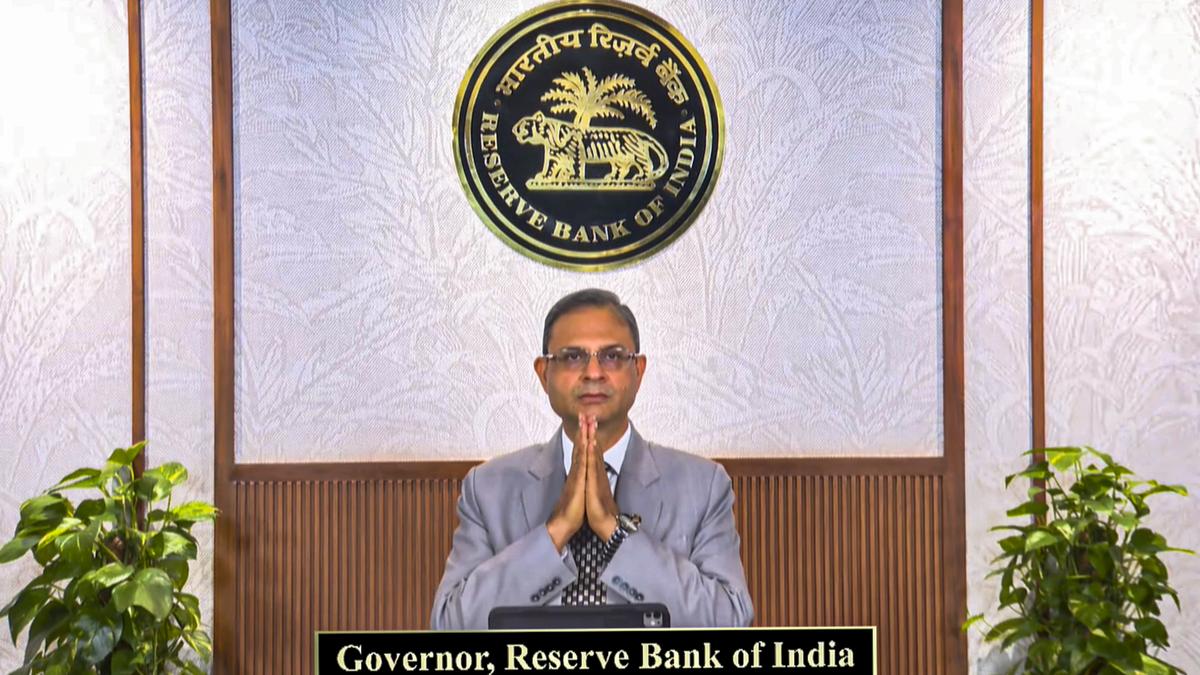

India continues to remain an attractive investment destination and rise in repatriation of funds is a sign of a mature market where foreign investors can enter and exit smoothly, Reserve Bank Governor Sanjay Malhotra said on Friday (June 6, 2025).

Gross foreign direct investment (FDI) inflows remained strong, rising by around 14% to $81 billion in 2024-25, from $71.3 billion a year ago. However, net FDI inflows moderated to $0.4 billion in 2024-25, from $10.1 billion a year ago.

In 2024-25, foreign portfolio investment (FPI) to India dropped sharply to $1.7 billion, as foreign portfolio investors booked profits in equities.

The moderation in net FDI "is on account of a rise in repatriation and net outward FDI, while gross FDI actually increased by 14 per cent," Mr. Malhotra said, while unveiling the June monetary policy.

Rise in repatriation is a sign of a mature market, where foreign investors can enter and exit smoothly, he said, adding "high gross FDI indicates that India continues to remain an attractive investment destination".

The governor also said that with the moderation in trade deficit in Q4:2024-25, alongside strong services exports and remittance receipts, the current account deficit (CAD) for 2024-25 is expected to remain low.

Furthermore, despite rising geopolitical uncertainties and trade tensions, India's merchandise trade remained robust in April 2025.

Northeast monsoon likely to end with slightly below-normal rain in T.N. after six-year surplus trend

Tamil Nadu's Northeast monsoon may conclude with below-normal rainfall, ending a six-year surplus trend amid prolonged dry weather.