RBI to introduce offline eRupee transactions soon: Shaktikanta Das

The Hindu

Digital Rupee users will soon be able to execute transactions in areas with limited internet connectivity as the Reserve Bank of India (RBI) on February 8 announced that offline capability will be introduced on the Central bank digital currency (CBDC) pilot project.

Digital Rupee users will soon be able to execute transactions in areas with limited internet connectivity as the Reserve Bank of India (RBI) on February 8 announced that offline capability will be introduced on the Central bank digital currency (CBDC) pilot project.

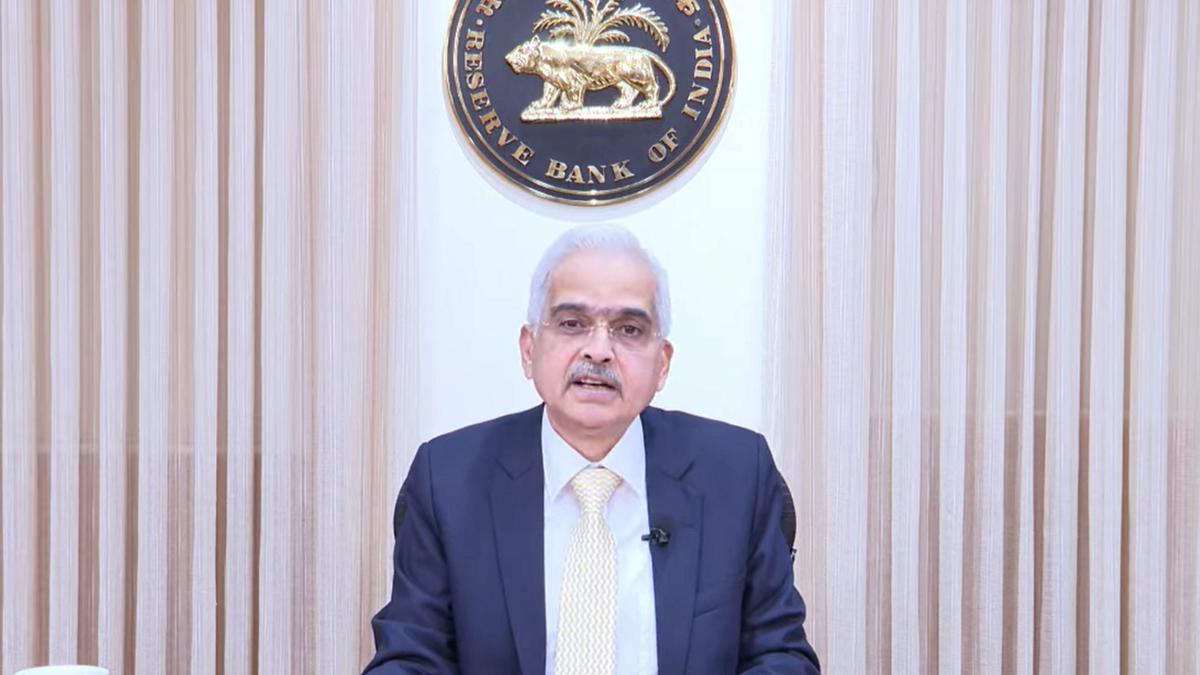

RBI Governor Shaktikanta Das said that programmability-based additional use cases will be introduced as part of the pilot project. RBI launched a pilot of the retail CBDC in December 2022 and achieved the target of having 10 lakh transactions a day in December 2023.

It can be noted that other payment platforms, especially the very popular Unified Payments Interface (UPI), already offer offline possibilities.

"It is proposed to introduce an offline functionality in CBDC-R (Retail) for enabling transactions in areas with poor or limited internet connectivity," Mr. Das said while announcing the bimonthly monetary policy review.

He said multiple offline solutions, which include both proximity and non-proximity based ones, will be tested across hilly areas, rural and urban locations for the purpose.

On the programmability front, he said that currently, the system enables Person to Person (P2P) and Person to Merchant (P2M) transactions using digital rupee wallets provided by pilot banks.

GCCs keep India’s tech job market alive, even as IT services industry embarks on a hiring moratorium

Global Capability Centres, offshore subsidiaries set up by multinational corporations, mostly known by an acronym GCCs, are now the primary engine sustaining India’s tech job market, contrasting sharply with the hiring slowdown witnessed by large firms in the country.

Mobile phones are increasingly migrating to smaller chips that are more energy efficient and powerful supported by specialised Neural Processing Units (NPUs) to accelerate AI workloads directly on devices, said Anku Jain, India Managing Director for MediaTek, a Taiwanese fabless semiconductor firm that claims a 47% market share India’s smartphone chipset market.

In one more instance of a wholly owned subsidiary of a Chinese multinational company in India getting ‘Indianised’, Bharti Enterprises, a diversified business conglomerate with interests in telecom, real estate, financial services and food processing among others, and the local arm of private equity major Warburg Pincus have announced to collectively own a 49% stake in Haier India, a subsidiary of the Haier Group which is headquartered in Qingdao, Shandong, China.