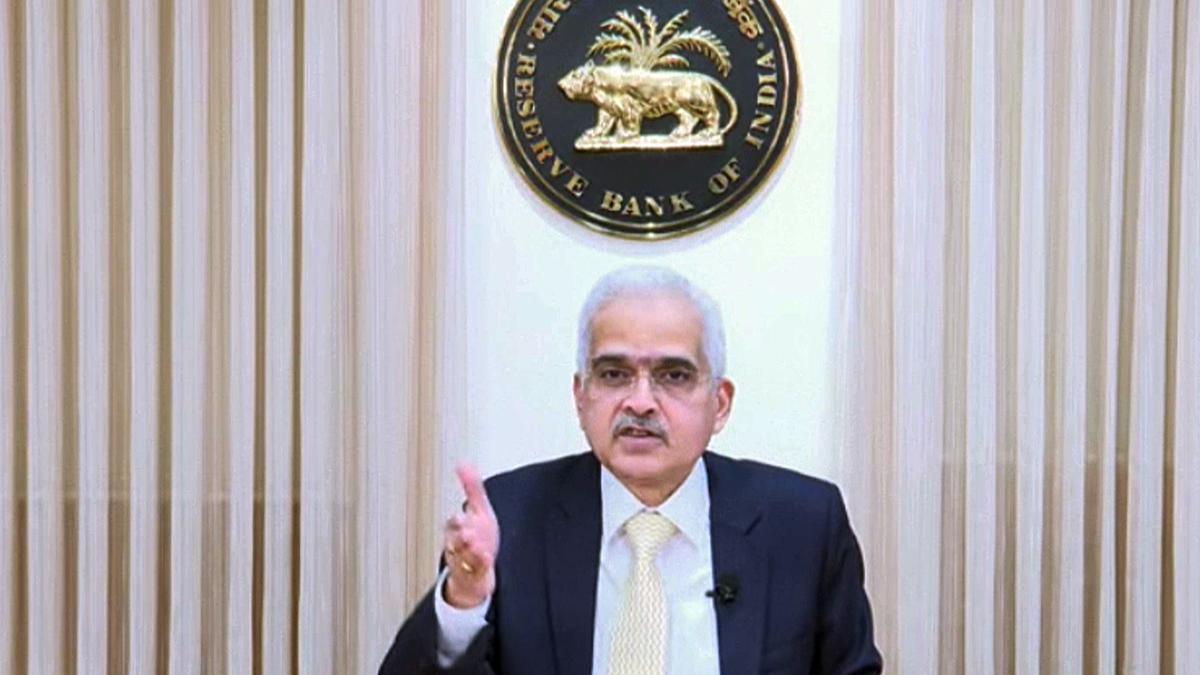

RBI sticks to its mandate to curb inflation by keeping rates unchanged

The Hindu

The Reserve Bank of India (RBI) has stuck to its playbook and has maintained status quo on the key policy rates and retained its stance of withdrawal of accommodation--which is consistent with its stated view of retaining sharp focus in aligning inflation to the target (of 4%) on a durable basis, while balancing economic growth and financial stability. The Governor re-emphasised this sufficiently when he said that only stable and low inflation at 4% will provide the necessary bedrock for sustainable and long-term economic growth.

Manish Kothari

The Reserve Bank of India (RBI) has stuck to its playbook and has maintained status quo on the key policy rates and retained its stance of withdrawal of accommodation--which is consistent with its stated view of retaining sharp focus in aligning inflation to the target (of 4%) on a durable basis, while balancing economic growth and financial stability. The Governor re-emphasised this sufficiently when he said that only stable and low inflation at 4% will provide the necessary bedrock for sustainable and long-term economic growth.

The Monetary Policy Committee (MPC) maintained its stance and policy rates unchanged, aligning with the stated objective of the government--to curb inflation. A similar thought was articulated by U.S. Federal Reserve Chair Jerome Powell in its recent meeting, at a time when the market was expecting a cut in rates.

Headline inflation, after moderating to 4.9% in October, rose to 5.7% in December 2023. This was primarily due to food inflation, mostly vegetables. RBI has reiterated that its stance of withdrawal of accommodation should be seen in the context of incomplete transmission and inflation which has been above the 4% target.

The softening in core inflation (CPI inflation excluding food and fuel) continued across both goods and services, reflecting the cumulative impact of monetary policy actions as well as significant softening in commodity prices. The uncertainties in food prices, however, continue to impinge on the headline inflation trajectory.

Amidst a globally varied economic landscape, certain factors suggest a potential soft-landing scenario. Inflation is edging closer to the 4% target, and both advanced as well as emerging market economies are exhibiting more resilient growth than initially anticipated.

Robust domestic demand

Mobile phones are increasingly migrating to smaller chips that are more energy efficient and powerful supported by specialised Neural Processing Units (NPUs) to accelerate AI workloads directly on devices, said Anku Jain, India Managing Director for MediaTek, a Taiwanese fabless semiconductor firm that claims a 47% market share India’s smartphone chipset market.

In one more instance of a wholly owned subsidiary of a Chinese multinational company in India getting ‘Indianised’, Bharti Enterprises, a diversified business conglomerate with interests in telecom, real estate, financial services and food processing among others, and the local arm of private equity major Warburg Pincus have announced to collectively own a 49% stake in Haier India, a subsidiary of the Haier Group which is headquartered in Qingdao, Shandong, China.