Oil edges higher after four-day retreat as traders look to China

BNN Bloomberg

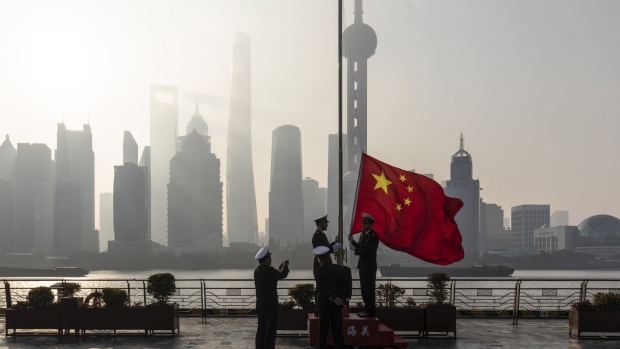

Oil snapped a four-day drop as investors weighed the impact of China’s moves to ease virus curbs against the risk of an economic slowdown in the U.S..

West Texas Intermediate climbed toward US$73 a barrel after plunging more than 11 per cent over the previous four sessions. In recent days, a gloomy economic outlook — and apparent lack of disruption to supply after sanctions took effect on Russia — has pushed down prices. Yet positive signals from China, which is rolling back COVID restrictions, have brightened the prospects for demand.

Oil has weakened this month, erasing all of the year’s once-substantial gains, as central banks tighten monetary policy and the macroeconomic outlook sours. The pace of the selloff in recent weeks means that the global Brent benchmark is now oversold, one sign that the market rout could be nearing an end.

“Short-term technical traders are in control as the overall level of participation continues to fall ahead of year-end,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. “It has been a very difficult year across markets and an early closing of books seems to be unfolding.”