Middle income group: Higher exemption limit on savings will put money in our pocket, says retired professor

The Hindu

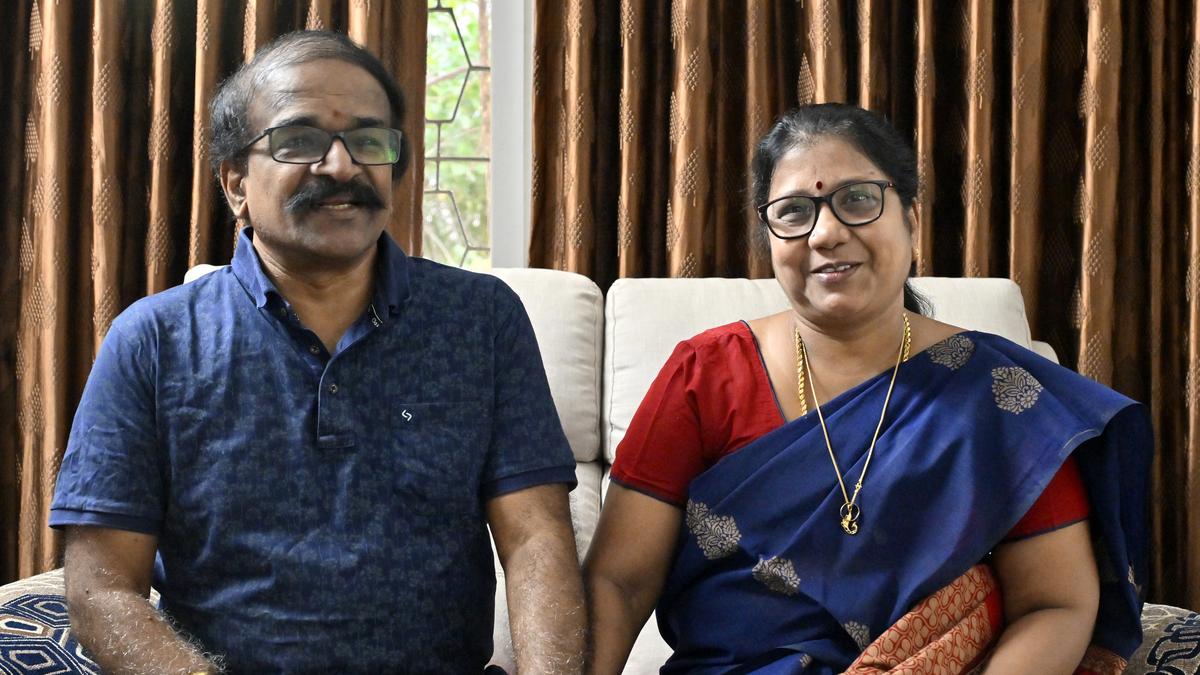

Retired professor S. Selladurai reviews Union Budget, highlighting benefits for salaried class, skill development, and education loans.

Annual income: ₹17 lakh

No. of family members: 3

The Union Budget has minor benefits for the salaried class and retired people, said S. Selladurai, a retired professor of Anna University. The increase in the standard deduction limit from ₹50,000 to ₹75,000 is welcome, he said.

“I appreciate the initiative of giving importance to skill development in the Budget. The government has been focusing every year on developing skillsets, but what happens to those who have developed skills? Are they getting jobs? Employers say students are not skilled, but even if we give them sufficient training, there will be a benefit only if there are sufficient jobs. There is no mention of improving job opportunities,” he said.

The Budget has offered to waive the interest on higher education loans to some extent, which is welcome, he said.

“There is no mention of any relief for senior citizens. We expected an exemption from interest on our investments post retirement. An increase in the limit of exemption would have benefited us,” he said.

The prices of groceries, especially lentils, have been soaring. The prices will fall only if the cost of petrol and diesel is brought down. There are small benefits in the changes to the slabs. I may save approximately ₹17,000 annually.

The latest Household Consumption Expenditure Survey (HCES) by MoS&PI reveals a transformative shift in India’s economic landscape. For the first time in over a decade, granular data on Monthly Per Capita Expenditure (MPCE) highlights a significant decline in the proportional share of food spending—a classic validation of Engel’s Law as real incomes rise. Between 1999 and 2024, both rural and urban consumption pivoted away from staple-heavy diets toward protein-rich foods, health, education, and conveyance. As Indian households move beyond subsistence, these shifting Indian household spending patterns offer vital insights for social sector policy, poverty estimation, and the lived realities of an expanding middle-income population.