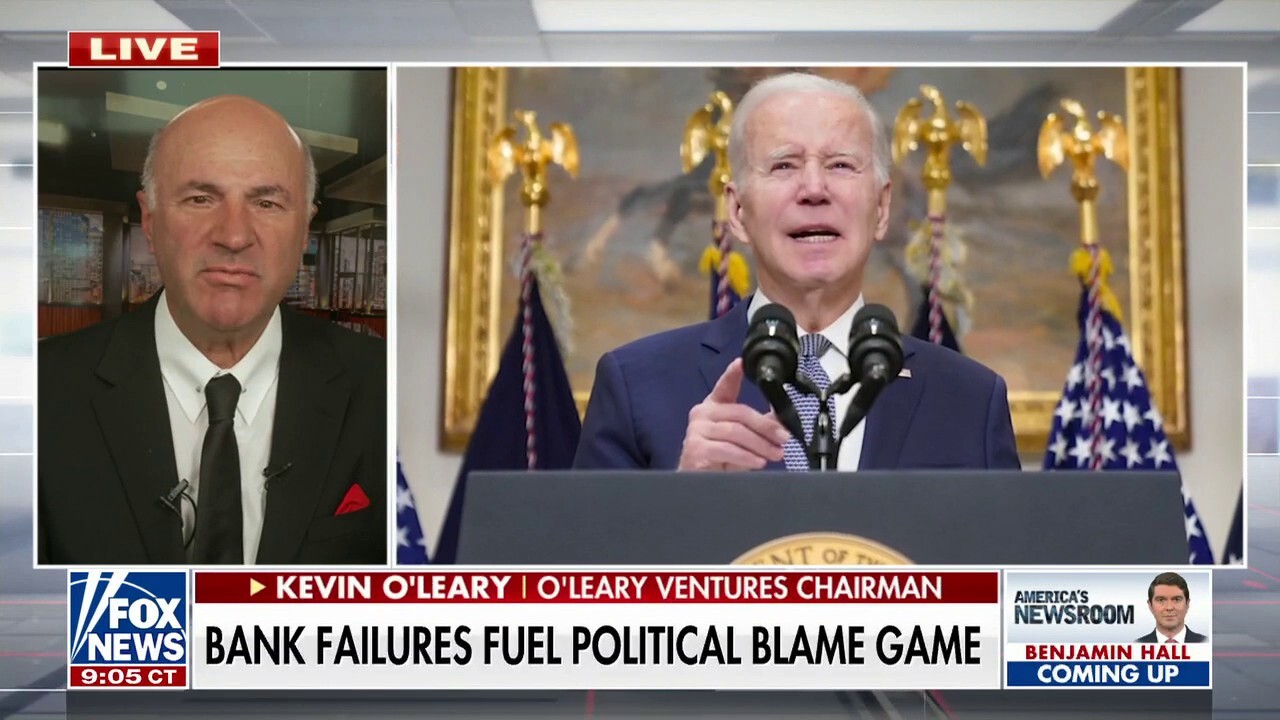

Kevin O'Leary rejects Biden admin's response to SVB collapse: 'We should not have done this'

Fox News

Kevin O'Leary joined "America's Newsroom" to discuss Silicon Valley Bank's failure and the consequences of creating 'no-risk banking' systems.

KEVIN O'LEARY: Let's take the case of Silicon Valley Bank. That was not the Fed's fault. That was not regulatory issues. It was just plain, straight idiot management underneath an incompetent board. I hate to put it that way, but those are the facts. And so at the end of the day, you can't protect yourself against idiot management in any sector, including banking. There's always a black swan swimming around in the lake somewhere, and you found it in Silicon Valley Bank. But here's where we're at this morning with this new policy. I don't care what bank we're talking about anymore. You as a depositor have no risk whatsoever. So what stops the idiot bank manager going forward from doing anything they want within the regulatory environment, taking as much risk as possible to get the stock price of that bank up, that's how they're compensated.

This is going to create some very perverse acts by bank managers and crazy behaviors. And in the end, it's not a long-term solution whatsoever because either you decide to nationalize the banks, in which case all the bank managers work for taxpayers as employees, just like giant utilities, or you let the private sector be the private sector. And within that, you have collapses by idiot managers like the Silicon Valley Bank, which, by the way, at the end of the day would have only cost depositors around 5%. Those that were uninsured above 250,000. And frankly, the people that have money, the more than 250,000, are the sophisticated investors. They can take the hit. We shouldn't have done this. And now we have the moral jeopardy ahead of us of idiot bank managers everywhere doing crazy behavior.

The Biden administration is gearing up to investigate the collapse of Silicon Valley Bank, which was the 16th-largest bank in the United States before it went under after a run on the bank last week.