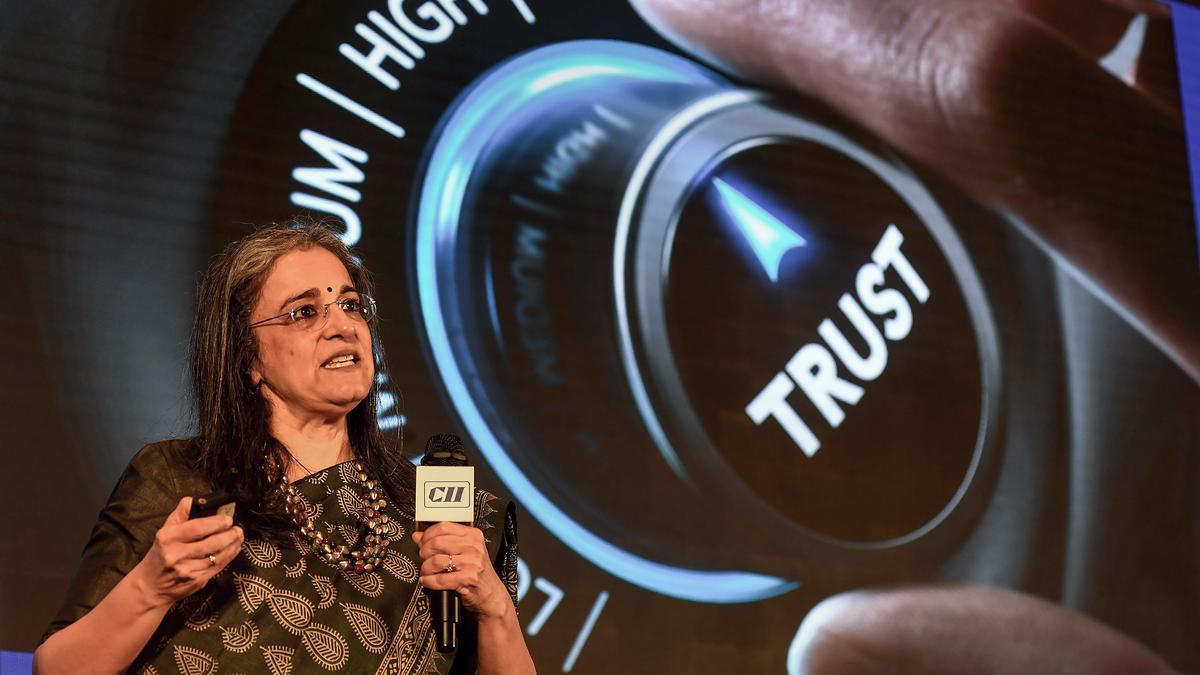

Hindenburg attacking credibility, attempting character assassination: SEBI chief Madhabi, husband issue detailed rebuttal

The Hindu

Buchs defend against Hindenburg allegations, clarifying investments and associations, denouncing attacks on SEBI credibility.

U.S.-based short-seller Hindenburg Research is attacking capital markets regulator SEBI’s credibility and attempting a character assassination of its chief, Madhabi Puri Buch and her husband Dhaval said on Sunday (August 11, 2024).

In a detailed statement issued this evening, the Buchs clarified on the raft of allegations made by Hindenburg in a report on Saturday (August 10, 2024).

"They have chosen to attack the credibility of Sebi and attempt character assassination of the Sebi chairperson," the statement said.

Hindenburg had alleged that it suspects SEBI’s unwillingness to act against Adani Group may be because Ms. Madhabi had stakes in offshore funds linked to the conglomerate. The Buchs had immediately termed the allegations “baseless” in an early morning statement.

While Ms. Madhabi serves as the chairperson of SEBI, her husband is a senior advisor with Blackstone.

In the fresh statement, the Buchs said their investment in a fund promoted by IIFL Wealth Management was as Singapore-based private citizens, and made two years before Ms. Madhabi joined SEBI as a whole-time member in 2017.

According to the statement, Buchs decided to invest in the two funds on advice of Mr. Dhaval's childhood friend, Anil Ahuja.

GCCs keep India’s tech job market alive, even as IT services industry embarks on a hiring moratorium

Global Capability Centres, offshore subsidiaries set up by multinational corporations, mostly known by an acronym GCCs, are now the primary engine sustaining India’s tech job market, contrasting sharply with the hiring slowdown witnessed by large firms in the country.

Mobile phones are increasingly migrating to smaller chips that are more energy efficient and powerful supported by specialised Neural Processing Units (NPUs) to accelerate AI workloads directly on devices, said Anku Jain, India Managing Director for MediaTek, a Taiwanese fabless semiconductor firm that claims a 47% market share India’s smartphone chipset market.

In one more instance of a wholly owned subsidiary of a Chinese multinational company in India getting ‘Indianised’, Bharti Enterprises, a diversified business conglomerate with interests in telecom, real estate, financial services and food processing among others, and the local arm of private equity major Warburg Pincus have announced to collectively own a 49% stake in Haier India, a subsidiary of the Haier Group which is headquartered in Qingdao, Shandong, China.