Explained | The FM’s call for industrial investment

The Hindu

Why did the Union Finance Minister urge industry giants to invest in manufacturing? Is private sector financing at an all-time low? Has government intervention to boost and spend aggressively on infrastructure come at an opportune time?

The story so far: Last month, Finance Minister Nirmala Sitharaman asked captains of industry what was holding them back from investing in manufacturing. She likened industry to Lord Hanuman from the Ramayana by stating that industry did not realise its own strength and that it should forge ahead with confidence. She said, “This is the time for India… We cannot miss the bus”.

Clearly, the Finance Minister did not see investments happening at a pace she would have liked. In the hope of revitalising private investment, the government had in September 2019 cut the tax rate for domestic companies from 30% to 22% if they stopped availing of any other tax SOP (standard operating procedure).

Niranjan Rajadhyaksha, CEO of Artha Global, says that Indian private sector investment has been weak for almost a decade now. “If we look at drivers of economic growth right now, there are amber lights flashing. The export story will be under threat because of the global slowdown, the government’s ability to support domestic demand would also be limited as the fiscal deficit comes down. Because of the K-shaped recovery, private consumption is only concentrated in some parts of the income pyramid.”

Let’s look at some indicators over the past few months; generally, changes in numbers are with respect to year-earlier figures, but when we have been through something as sudden and life-changing as a pandemic for at least two years, it is useful to see how figures from quarter to quarter or month to month have changed. This gives us an idea of how well or poorly we are recovering. In the GDP figures for the quarter ended June, gross fixed capital formation (GFCF) at 2011-12 prices rose 9.6% to ₹12.77 lakh crore, from ₹11.66 lakh crore in Q1 of FY20, which was the pre-pandemic period. This is in context of the overall GDP growth of 2.8% to ₹36.85 lakh crore in Q1 FY23 from ₹35.85 lakh crore in Q1 of FY20. Manufacturing GVA (gross value added) also rose 6.5% to ₹6,05,104 in Q1 FY23 from ₹5,68,104 in Q1, FY20. However, when one observes manufacturing growth from the immediately preceding quarter April-June vs January-March, we see that the sector has suffered a 10.5% contraction. While private final consumption expenditure, an essential pillar of our economy, climbed 26% year-on-year for the June quarter, the ₹22.08 lakh crore of private spending in April-June 2022 was a significant ₹54,000 crore, or 2.4%, less than that spent in the preceding quarter. And GFCF, which is viewed as a proxy for private investment, shrank quarter-on-quarter by 6.8%.

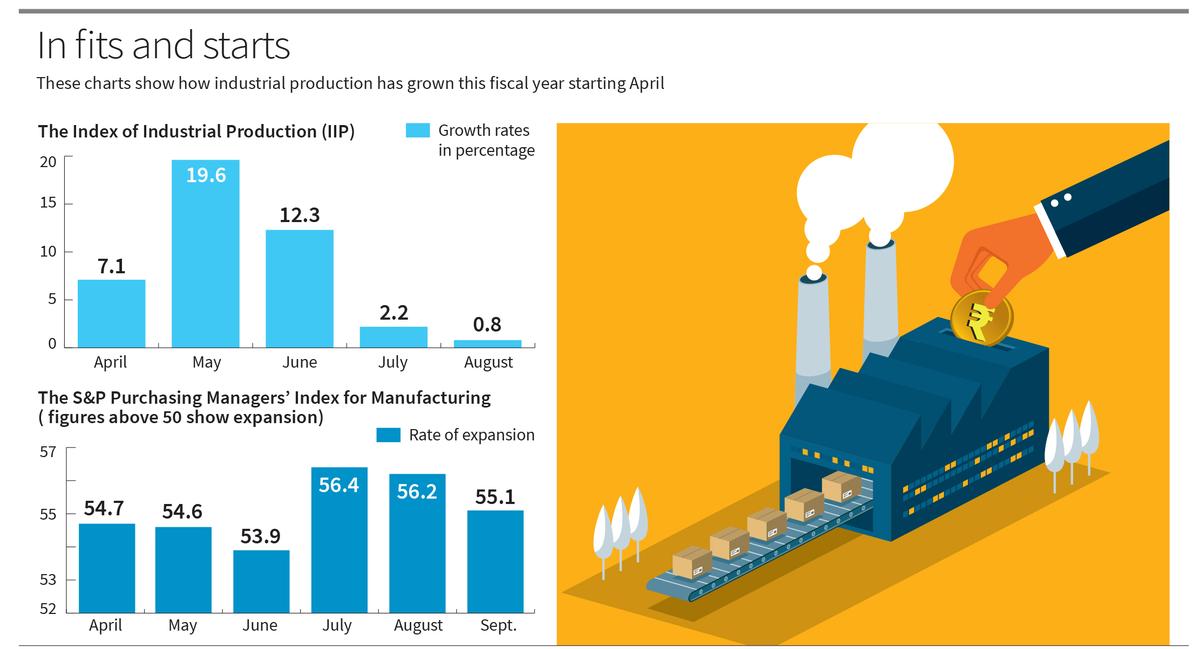

Industrial production has shown growth in each of the first five months of this fiscal year starting April, compared with a year earlier; but worryingly, monthly numbers as seen on the Index of Industrial Production (IIP) and the S&P Purchasing Managers’ Index (PMI) for Manufacturing have progressed in fits and starts. In an article in The Hindu earlier this month, Pulapre Balakrishnan, who teaches at Ashoka University at Sonipat in Haryana, argued that capital expenditure by the government is a precursor to private investment but that it would take a sustained trend in public spending, for about half a decade at least, to help kindle enthusiasm in the private sector. While the government’s intent to spend aggressively on infrastructure in its Budget for this fiscal is encouraging, he says this cycle should have started a few years ago. With the government having now announced intent, he says it must now focus on a couple of priorities; one that it must identify the right projects — investments must be made in productivity-enhancing infrastructure. Two, he warns that inflation could derail the best designed public spending programmes, and urges a step up in agricultural produce to help rein in food inflation.

Private companies invest when they are able to estimate profits, and that comes from demand. The Centre for Monitoring Indian Economy’s (CMIE) consumer sentiment index is still below pre-pandemic levels but is far higher than what was seen 12-18 months ago. RBI’s Monetary policy report dated September 30 says, “Data for Q2 [ended Sept] indicate that aggregate demand remained buoyant, supported by the ongoing recovery in private consumption and investment demand.” It shows that seasonally adjusted capacity utilisation rose to 74.3% in Q1 — the highest in the last three years. Manufacturing firms recorded a sequential uptick in new orders while infrastructure firms displayed optimism on the overall business situation, turnover and employment in Q2:2022-23.

In an article on the State of the Economy in RBI’s monthly bulletin released last week, the authors led by Deputy Governor Michael Debabrata Patra emphasised that contact-intensive sectors would likely lead the rejuvenation as the restraint due to the pandemic has waned. “Festival-related spending was already boosting consumption demand with positive externalities for other components of domestic demand.”