As Trump threatens BRICS nations with tariff barrier, Das says India has no plans for de-dollarisation

The Hindu

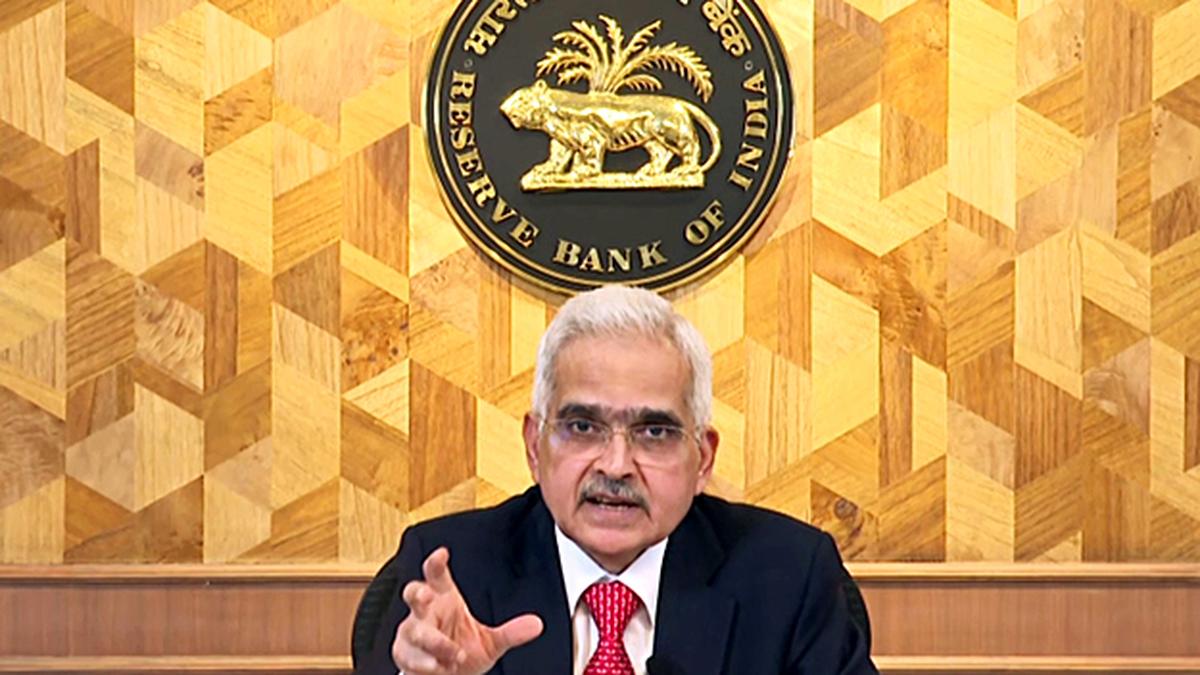

RBI Governor Shaktikanta Das states India has no plans for de-dollarisation despite potential tariff wars and forex reserves are robust.

India has no plans for de-dollarisation, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Friday in response to a question on U.S. President-elect Donald Trump’s threat to impose 100% tariff on BRICS nations planning to have a common currency to challenge the dominance of U.S. dollar in global trade.

“The BRICS currency was an idea which was raised by one of the members of the BRICS countries and it was discussed,” Mr. Das said. “No decision has been taken in the matter. The geographical spread of the countries also is a factor which has to be kept in mind unlike the Eurozone which has a single currency and they have geographical continuity. BRICS countries are spread all over,” he added.

“That also has to be kept in mind. And with regard to the dollar, so far as India is concerned, there is no step which we have taken to de-dollarize. All that we have done is that we have entered into agreement with couple of countries by to do local currency-denominated trade. That is basically to de-risk our Indian trade,” he said.

“Dependence on one currency can be problematic at times because of appreciation or depreciation. So, as a part of de-risking our trade, that is a step which has been taken. De-dollarisation is certainly not our objective. It is not on the table at all. Our effort is basically to de-risk our trade. Nobody is talking about or thinking about de-dollarisation,” he emphasised.

Answering a question if the rupee could come under pressure due to possible tariff wars and Indian exports could be hurt, the Governor said, “If the tariff war happens... hypothetically, if it happens, it will not be an isolated event. There will be other events around it, like, for instance, perhaps, China may react by devaluing the currency or there might be retaliatory tariffs.”

“So, at this point, it is very difficult to say what will be our unilateral move, and will it affect. Let us wait for the general equilibrium,” he added.

Mr. Das said India’s forex reserves are quite robust now and are still quite adequate.